5 Budgeting Methods to Manage Your Money

- Catrina Joy Morcozo

- Jun 22, 2022

- 4 min read

Updated: Jul 6, 2022

One of the basics of achieving financial freedom is to save and invest. But how can we save when most of our income goes to our expenses? That's where BUDGETING comes in. We have to make a wise budget plan to control our money. Otherwise, money will control us.

Here are 5 Budgeting Methods to Consider in Managing your Money:

1. ZERO-BASED BUDGET METHOD

In this budgeting method, you distribute your income between expenses every month so that your income minus expenses equals zero.

An advantage of this method is that this gives you the clearest overview of where the money is spent. However, this might be time-consuming for beginners since you have to dig into the details behind each line item.

Therefore, this budgeting method is best for people who have a fixed income each month or at least can reasonably estimate their monthly income. After calculating your monthly income, add up your monthly spending and savings to equal that income amount.

2. PAY-YOURSELF-FIRST BUDGET METHOD

The pay-yourself-first budget is another simple budgeting method that focuses primarily on savings and debt repayment.

You simply set aside a specific amount every time you get paid for savings and debt payments, then spend the rest of your money however you see fit. By doing this, you can prioritize your savings and debt repayment goals and make do with whatever is left over.

For example, you may want to focus on paying off high-interest debt first while slowly building up an emergency fund. But as you get rid of your high-interest debt, you could focus on other savings goals.

An advantage of this is it helps you reach your savings and debt payment plans the fastest. Although, this doesn't give you a clear overview of where you might be spending money unnecessarily.

3. ENVELOPE SYSTEM BUDGET METHOD

This budgeting method is quite similar to zero-based budgeting but you do this with ALL cash.

In an envelope budgeting system, you plan out how you’re going to spend your money each month and use an envelope for each spending category. Then you withdraw as much cash as you need to fill each envelope based on your budget.

One example is when you do grocery shopping, you only take the envelope intended for that purpose. And the amount you put per envelope is the only cash you need to spend for the whole month unless you want to take cash from other envelopes. Avoid raiding other envelopes too often, though, because it can cause a snowball effect and you can run out of cash before the end of the month and end up being in the cycle of "Petsa de Peligro".

This is not a good budgeting method though for someone who doesn’t feel comfortable having that much cash on hand or prefers using credit cards or debit cards.

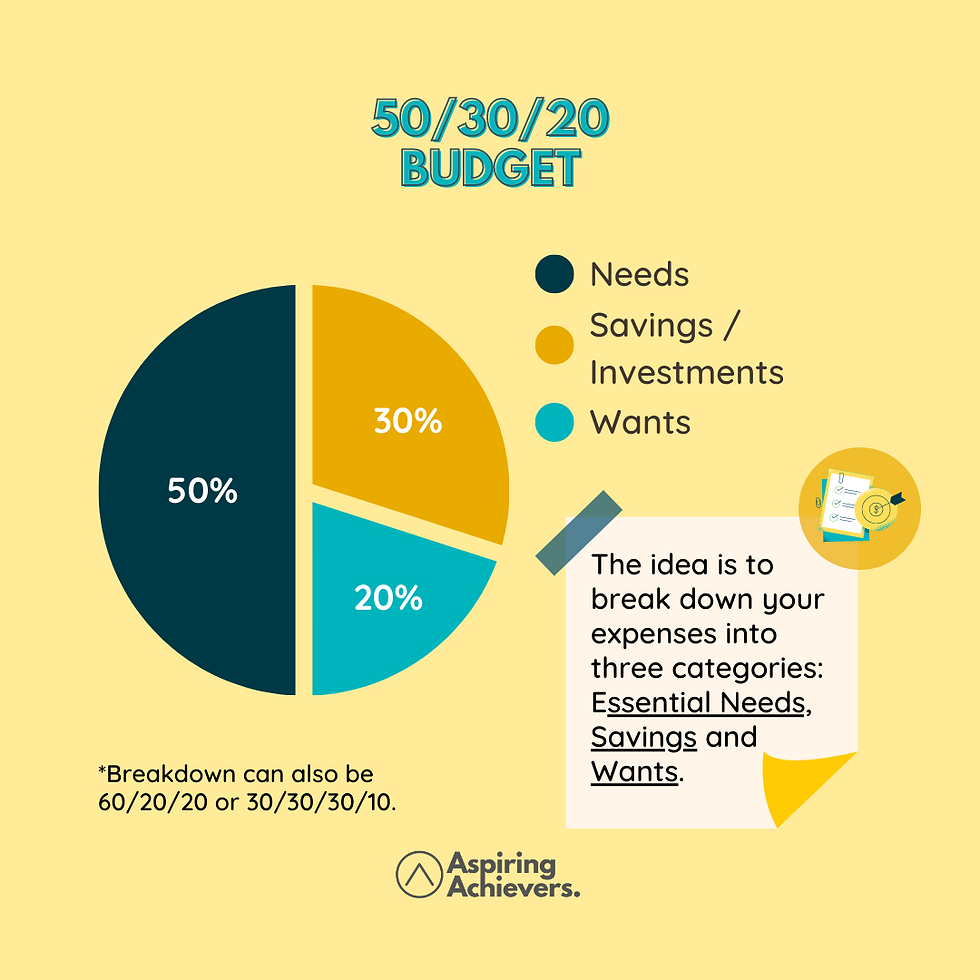

4. 50/30/20 BUDGET METHOD

This budgeting method is the most flexible and customizable. The idea is to break down your expenses into three categories:

1. Essential Needs (50%) 2. Savings (30%) 3. Wants (20%)

This is a great option for newbie budgeters because it doesn’t require meticulous tracking of all your expenses. You can succeed with this budget as long as you know what counts as a want versus a need and put enough money toward savings and debt.

The main drawback is that the 50/30/20 rule might be unrealistic for people who have a lot of debt or have big savings goals. But the good news is that you can customize it to fit your needs by using different proportions of break down such as 60/20/20 wherein Needs (60%), Savings (20%), and Wants (20%) or 30/30/30/10 wherein Rent/Loans (30%), Needs (30%), Savings (30%), and Wants (10%).

5. THE "NO" BUDGET

In simple words, do not spend money you don't have. Instead of creating a budget, you can do the following to manage your money:

Monitor your savings bank accounts weekly or monthly to track your spending.

Take note of the due dates for recurring bills such as electricity, water, and phone bills payments. You may jot a reminder in a calendar or notification in your mobile phone calendar so you won't forget.

Make sure to set aside cash for savings and debt repayments to avoid unnecessary penalties caused by overdue payments. Only spend what's left over for the month.

While the “no” budget sounds easier than the other methods we’ve posted, it’s not always easy to tell yourself “no.” This budgeting method is best if you’ve demonstrated spending discipline in the past and are confident that you can continue that streak.

Whatever method you may choose, always remember that even if you pick the right budgeting method, it can still take a few months to get used to the system, especially if you’ve never budgeted before. But like any habit, the more you do it, the easier it becomes.

Always think about the "whys" you want to take more control over your money. Is it to break free from debts? Save for your child's future education? Start a business? Acquire a property or car? Invest for your retirement? Consider your goals and why you want to achieve them. Re-assessing your "why's" and your goals can help you regain your motivation to keep working to improve your budgeting skills.

Also, don’t be afraid to make changes to your budgeting strategy to make it more effective. For example, try a different budgeting method if one isn’t working for you, or make adjustments to one to tailor it to your needs. And try using a budgeting app to help make the process easier.

The most important thing is that you start the habit of managing your money to help you improve your financial health and achieve your goals.

Comments